Key Takeaway: UK packaging regulations are changing fast: understanding EPR, Plastic Packaging Tax, and compliance obligations is essential for businesses to reduce costs, stay legal, and minimise environmental impact. As UK packaging rules are set to yet again tighten in 2026, understanding the range of compliance obligations is key for businesses to stay legal, cut costs and drive sustainability.

It seems with every passing year, there is a new green tax, initiative or regulation to adhere to. With many experiencing 2025 as the year of unsustainable costs (National Insurance and the new workplace recycling scheme adding more financial pressure), how are organisations preparing for these sustainability taxes? Navigating which ones apply and how to mitigate liability is now suddenly a resource issue in itself.

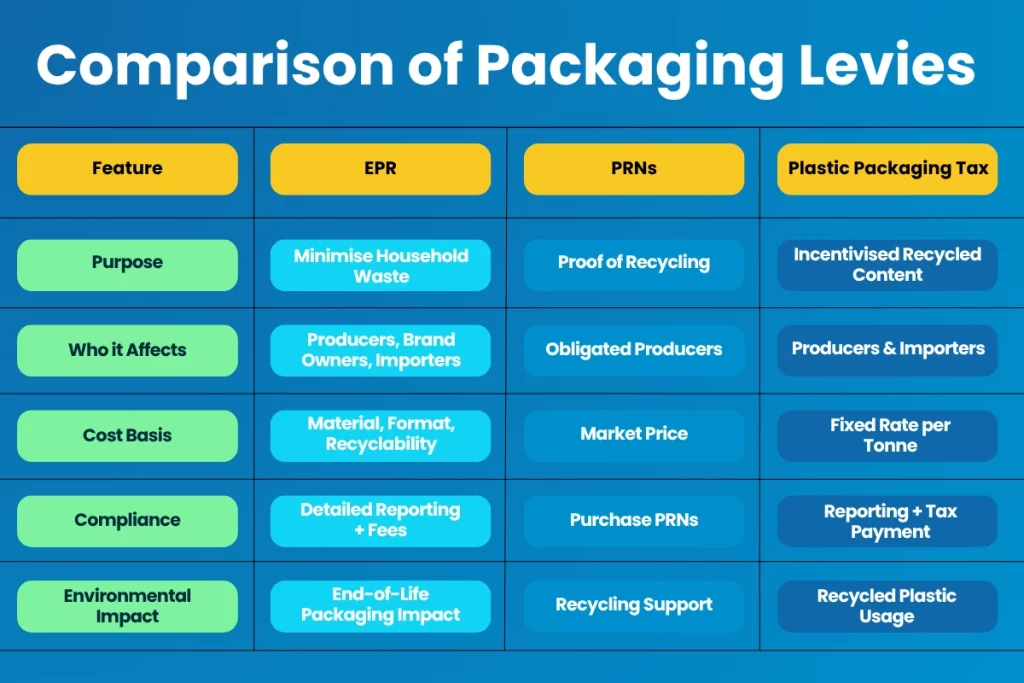

DEFRA, the Environment Agency and HMRC are spearheading their individual sustainability schemes which can at times appear to be at odds with each other while trying to achieve similar packaging reduction objectives. While interconnected, each serve different purposes in the overall waste management strategy.

Whether you’re a retailer, manufacturer or supply chain manager, understanding the key differences between EPR, PRNs, and PPT is vital to staying compliant, competitive, and environmentally responsible.

So let’s take a look at how these taxes are designed to improve packaging design, reduce plastic waste and lead to a more circular economy. Read on to understand more about how Extended Producer Responsibility (EPR), Packaging Recovery Notes (PRN’s) and the Plastic Packaging Tax (PPT) applies to brand owners, packaging producers and users.

What it is:

EPR shifts the responsibility for the environmental impact of packaging from local authorities to the producers. This is a fundamental change in how packaging waste is collected and managed in the UK meaning that the packaging producers and retail brand owners will pay the cost for household waste collections, recycling, and disposal of all packaging waste.

Key features:

Why it matters:

It’s no longer just about recycling – it’s about making smarter packaging design choices upfront. EPR penalises packaging that’s hard to recycle and rewards recyclable materials, making sure that packaging sustainability is now considered before anything else in the packaging design process.

What they are:

PRNs are certificates that prove the amount of packaging waste has been recovered or recycled. Under the current system, obligated companies must purchase PRN’s to offset the packaging they produce and place on the market.

Key features:

Why it matters:

PRNs have been the cornerstone of packaging compliance for years. While EPR will change the landscape, PRNs will continue to play a role in funding recycling through evidence-based compliance.

What it is:

Introduced in April 2022, the Plastic Packaging Tax applies to plastic packaging manufactured in or imported into the UK that contains less than 30% recycled plastic.This applies whether it is PCR (post consumer recycled waste) or PIR (post industrial recycled waste) pallet wrap. It was designed to stimulate the need for recycled content by creating a cost incentive for using less virgin plastic. The long term ambition is to encourage investment in plastic recycling infrastructure.

Key features:

Why it matters:

PPT is a financial lever to increase demand for recycled plastic. It affects pricing, procurement and packaging development. Compliance is mandatory, whether you’re a brand owner or distributor.

EPR covers all packaging materials and entire lifecycle costs

PRNs focus specifically on recycling evidence

Plastic Packaging Tax specifically targets virgin plastic content

Packaging levies are here to stay

The regulatory landscape is only going to get tougher as we try to tackle the impact packaging waste is having on our environment which could look like:

A large number of businesses will need to comply with all three of these Regulations which can lead to compliance complexities such as understanding the different reporting requirements, thresholds and timelines needed to manage each effectively. Then there is navigating the potentially conflicting definitions and scopes between the schemes.

For example, HMRC’s Plastic Packaging Tax is purely focussed on the proportion of recycled plastic content being used and is not concerned with end of life waste management and therefore might not have an impact on wider plastic pollution issues. Whilst EPR is not concerned with the packaging material itself – but more on how easy it is to dispose of when used.

However, collectively the schemes target different aspects of sustainability and holistically drives demand for recycled content and better end of life recyclability.

Achieving and maintaining compliance

No doubt your business is well on its way with data collection and reporting, but there are always ways to extend your knowledge and reduce your overall liabilities:

Staying ahead of these regulations isn’t just about avoiding fines — it’s about futureproofing your brand, improving your sustainability credentials, and protecting your bottom line.

When approached strategically, these systems can drive meaningful progress toward a more circular packaging economy—reducing virgin material use while ensuring packaging is effectively collected, sorted, and recycled at end-of-life.

Need help navigating EPR, PRNs or PPT in 2026? Let’s chat – we make compliance clear, not complicated.